The most common type of price chart used to identify patterns that may give clues to future price movements in the investment under scrutiny. Price is plotted vertically and time horizontally. The price change for each unit of time - day, week, month, and so on - is plotted by a vertical bar, the top and bottom representing the high and low respectively for each period. Usually there will be a horizontal tick attached to the bar, representing the closing price. On the bottom of the chart more bars sometimes plot the volume of business transacted, scaled to the right-hand axis. This helps correlate price changes to volume of business done, which may be significant. For B example, a surge in the price of a share to new highs based on little volume could be a sign of impending weakness or, alternatively, a sign of strength if the buying has been done by informed insiders.

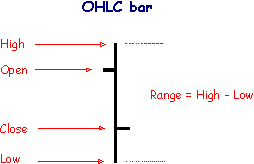

The most common type of price chart used to identify patterns that may give clues to future price movements in the investment under scrutiny. Price is plotted vertically and time horizontally. The price change for each unit of time - day, week, month, and so on - is plotted by a vertical bar, the top and bottom representing the high and low respectively for each period. Usually there will be a horizontal tick attached to the bar, representing the closing price. On the bottom of the chart more bars sometimes plot the volume of business transacted, scaled to the right-hand axis. This helps correlate price changes to volume of business done, which may be significant. For B example, a surge in the price of a share to new highs based on little volume could be a sign of impending weakness or, alternatively, a sign of strength if the buying has been done by informed insiders.An open-high-low-close chart (also OHLC chart, or simply bar chart) is a type of chart typically used to illustrate movements in the price of a financial

instrument over time. Each vertical line on the chart shows the price range (the highest and lowest prices) over one unit of time, e.g. one day or one hour. Tick marks project from each side of the line indicating the opening price (e.g. for a daily bar chart this would be the starting price for that day) on the left, and the closing price for that time period on the right. The bars may be shown in different hues depending on whether prices rose or fell in that period.

instrument over time. Each vertical line on the chart shows the price range (the highest and lowest prices) over one unit of time, e.g. one day or one hour. Tick marks project from each side of the line indicating the opening price (e.g. for a daily bar chart this would be the starting price for that day) on the left, and the closing price for that time period on the right. The bars may be shown in different hues depending on whether prices rose or fell in that period.This type of chart is often used by technical analysts to spot trends and view stock movements, particularly on a shorter term basis.

No comments:

Post a Comment